As we know, recently, our respected finance minister, Nirmala Sitharaman, announced that those with a business profits excess of Rs 5 cr are required to create a 6-digit HSN code; so, what is the HSN Code? If you want to know about HSN code, here is your article with all the details about HSN code briefly.

What is the HSN code?

HSN means “Harmonized System of Nomenclature”. HSN code was expanded in India by WCO, representing the World Customs Organization. This standard system separates goods from around the world in an orderly and efficient manner.

This system started to know in 1988. This HNS code is a 6-digit code that distinguishes all the different products. This system is responsible for all B2B and B2C tax invoices on the provision of Goods and Services. This is a type of system that is available nationally and internationally.

Importance of HSN code

Since this standard is accepted worldwide, the first 6 digits of the HSN code are the same in all countries. However, in order to make differentiate, countries have added additional digits to their HSN code programs.

For example, in India, we have a 4, 6 and 8-digit category, while the US uses another HTS code called the Compliant Expenditure List, which has 10 classification categories. It is also important for the collection of statistics on international trade. The main purpose of HSN codes is to make GST known systematically and globally. HSN codes also eliminate the need to load all product descriptions and details and help save time and make shipping easier as GST recovery is automatic.

Understanding the HSN code

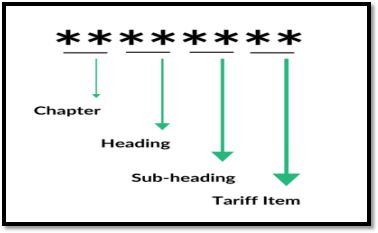

The HSN code consists of 21 sections divided into 99 chapters and divided into 1244 sections. This system helps to make GST easier and more accepted by worldwide. HSN codes for 6-digit are more common. HSN codes apply to customs and GST. Tax restrictions which are used for GST purposes. In taxation, the HS code is determined as an item (4 digits), a small item (6 HS digits), and tax items (8 digits).

HSN code structure

The structure of the HSN code is 21 sections -99 chapters -1,244 articles -5,224 subtitles.

Each of the 21 sections is divided into chapters then each chapter has some topics that are further subdivided into subheadings; section and chapter titles describe the general categories of goods, and subheadings describe the goods and products in a detail and brief way.

It is important to know that Indian manufacturers need to follow this HSN code structure.

| Sr No | HSN code | Annual Turnover |

|---|---|---|

| I | 0 | Below Rs 1.5 crore rupees |

| II | 2 | Above Rs 1.5 crore – Rs 5 crore rupees |

| III | 4 | Above Rs 5 crores |

Example of HSN code

• Example 1– India has 2 more digits for deep separation. If the handkerchief is made of synthetic fiber, the HSN code will be 62.13.90.10. If the same cloth or handkerchief is made of silk or silk waste, the HSN code will 62.13.90.90. This is a basic example of the HSN code.

• Example 2– If the benefit of Mr. Raju is over 5 cr, he must report the 6-letter HSN Code. If so, he will also identify the appropriate 6 digits in the HSN Code based on the product details. Let us imagine that his cement is shiny; will determine HSN Code 252330 as the most accurate code.

Where are the codes used?

Different services are also categorized in the same way for method, measurement, and taxation. The service codes are called the Service Accounting Code or SAC, which is issued by the Central Informal Tax and Customs Board (CBIC), to separate each service under the GST.

HSN code is required for everything from animal products, mineral products, plastic items to shoes, weapons, ammunition, and machinery. It is the most important code that should be present in all products.

Differences between HSN Code and SAC Code

HSN means for Harmonized System Nomenclature, which is widely used in many countries to classify assets for tax purposes, as well as to claim profits, etc.

SAC means for the Service Accounting Code to classify assets according to tax purposes, claim benefits, etc.

Simply put, we can say – GST: Tax on (Goods + Services), and Ownership (HSN + SAC).

CONCLUSION

Many business owners do not understand the HSN code and search it online, therefore, this article will help you with HNS code details. The main purpose of HSN codes is to classify products in a systematic and logical way. This helps to divide the products and services in an equal also in international trading. The main purpose of HSN codes is to make the GST tax system in an organized manner and known to the worldwide. The codes also removes the need to include all the detailed product descriptions in the tax receipt, saving time and effort and making it easier for the business owner to complete the refund process.