The Most Popular Online International Payment Gateways

People are increasingly using online payments to buy food, shop, and book cabs even as the Country’s digital access rises. However, cyber hackers are constantly looking for ways to access users’ data in the digital world.

So, here is the article with all the top online payment methods, along with the details of the payment gateways. It’s essential to understand online payments, as nowadays you know what an international online payment is about. Here’s a list of the best global payment gateway services for businesses and personal use.

PayPal

When it comes to online sales and transactions, PayPal is a global superstar and one of the most trusted choices. PayPal is very simple to set up (making it a good choice for small enterprises and start-ups), and it provides a high level of brand recognition that can help potential buyers trust your firm.

PayPal is also a globally used online payments method for businesses looking for an international payment gateway, as it is available in over 200 countries/regions and supports 25 currencies.

Features:

| PCI compliance | Express checkout |

| Inventory tracking | Mobile card reader |

| Shopping cart | Barcode scanning |

| Virtual terminal | Online invoicing |

| Credit card reader | Bill me later |

Amazon pay

Despite being a newcomer to the payment scene, Amazon Pay is a wonderful option for everyone searching for a low-cost international payment service with a simple User experience. It also has extensive multi-currency capabilities, making it a perfect platform for your company to operate internationally.

Features:

| Automatic payments | Customer identity |

| Merchant website integration | Fraud protection |

| Inline checkout |

Payza

In only a few minutes, you may send or receive payments from anyone in the world with this popular app. It also includes a fun and easy-to-use User experience, a strong and unique security system, and dedicated customer service—all for free. Payza is unique in that it accepts bitcoin in addition to accepting and withdrawing funds from a bank account and credit card.

Features:

| Centralized management | Add funds and withdraw |

| Supports 22 currencies | Secure online payments |

| Request funds | Payment buttons |

| Operates in 190 countries | Shopping cart Integration |

| Local payment options |

Worldpay

Worldpay is a payment method which enables you to accept all card payments easily from the app or through a website. It’s one of the most known international payment gateways in the country, with over 120 currencies supported, making it easy to accept payments from customers all over the world. On the other hand, Worldpay demands relatively long commitments and may charge early withdrawal costs if you close your account early.

Features:

| Payment Processing | Multi-Channel eCommerce |

| Billing and Invoicing | B2B eCommerce Platform |

| eCommerce | Fast payouts |

Authorize.net

Authorize.net is an essential and known online platform. It’s been processing payments since 1996, after all! It’s also the most commonly used payment gateway on the Internet, and from 2008 to 2016, it won the Achievement in Customer Excellence (ACE) award. Because the company has been around for 20 years, it keeps up with the times, such as accepting Apple Pay. It’s no surprise that the company is quite well.

Features:

| E-check processing | Recurring billing |

| Retail payment | Customer information manager |

| Virtual terminal and batch upload | Sync for quickbooks |

| Mail/phone payment | Advanced fraud detection Suite |

Stripe

Unlike many other international payment gateway providers, Stripe offers a variety of APIs for payment gateways. This means you’ll have complete control over your new payment gateway and will be able to incorporate it into your online store easily. Stripe also takes payments in over 135 currencies and provides full local payment support.

Features:

| Mobile customer interface | Dispute handling |

| Multi-currency payouts | Open-source plugin |

| Clean canvas | Consolidated reports |

| Collaboration notes | Accounting integrations |

| Payment options | Unified payout |

| Embeddable checkout | Financial reporting |

| Authorization | Roles and permissions |

| Custom UI toolkit |

WePay

WePay is known for its excellent customer service and fraud control. On the other hand, customers like the fact that it has a virtual interface; they can make purchases without ever leaving their site. WePay also helps to utilize invoicing, event ticketing, marketing automation, and Know Your Customer collection and risk management.

Features:

| Integrated payments | Transaction-level reporting |

| Apple Pay compatibility | Account provisioning |

| Android Pay compatibility | Mobile point-of-sale |

| Direct bank transfers | High-level PCI security |

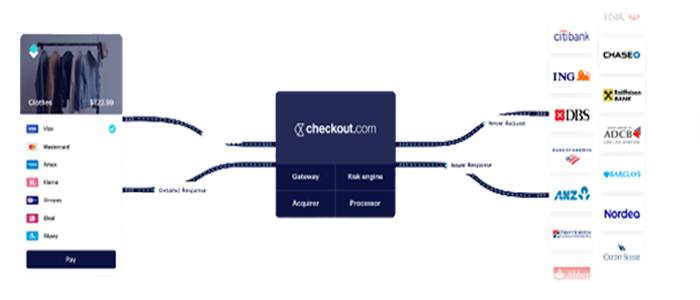

Checkout

Checkout.com is a website that allows you to shop online. Checkout.com is an amazing option with an all-in-one solution that combines merchant accounts and online payments. Checkout.com also accepts payments in 159 countries, and, despite the high cost, it can be a good option for low-volume businesses.

Features:

| Higher conversion | Less friction |

| Lower costs | Global partnership |

| 150+ processing currencies | Unrivaled data and insight |

Braintree

Although PayPal owns Braintree, the two companies function in quite different ways. In summary, Braintree offers unique merchant accounts via which you can process transactions. It can be a good alternative for organizations looking for an international payment gateway because it covers over 45 countries/regions.

Features:

| Drop-in UI | Braintree value |

| Supports 130 currencies | Easy data migration |

| 24*7 support | Guaranteed uptime |

| Customized checkout workflow | Advanced fraud protection |

| 2-day payout | Easy repeat billing |

| Dynamic control panel | Encryption |

Intuit quickbooks

For a small business owner, Intuit is almost necessary. Intuit can help you with tax payment calculations, in addition to accepting payments online and a person with the mobile GoPayment credit card processor. One of the most attractive aspects is the inexpensive monthly fee of $19.95, which only charges 1.6 percent for credit card swipes rather than the typical 2.40 percent.

Online merchants now have access to more online payments than ever before. Each platform has its ways of advantages and disadvantages, and it’s up to you to find out which is best for you. Accordingly, you go with that online payment method, especially for international transactions.