UAN Activation & Registration Process

UAN stands for Universal Account Number. Any account number is a unique identification number that assists you in safeguarding your information, money, and assets. Pay bills with the help of your bank account number and consumer number. The UAN number, with 12digit, uniquely identifies and safe your EPF (Employee Provident Fund) deposits.

Furthermore, it enables you to consolidate multiple PF accounts started for you by different employers under a single number that is only accessible to you. This is a kind of identification method which secures your deposits with a virtual lock and key while also making it easier to access and check on your EPF. So, here is the article that will guide you with UAN (Universal Account Number).

The Universal Account Number (UAN) is a 12-digit identification number issued to both you and your employer, enabling you and your employer to contribute to the EPF (Employee Provident Fund). The Employees’ Provident Fund Organization (EPFO) generates and issues this number, which is issued by the Ministry of Labour and Employment.

The EPFO assigns you and your employer in two separate UANs. Once generated, the UAN remains unchanged throughout the company’s years in business and throughout your employment years, regardless of how many positions you can change.

When you change the jobs, the EPFO will issue you as a new member identity number (ID) that will be linked to your existing UAN. You can also request for a member ID number directly from EPFO or through your employers, who will utilise your UAN to seek a new member ID from EPFO on your behalf.

Login Steps

Follow the steps given below to enter the UAN Member Portal

- Go to https://unifiedportal-mem.epfindia.gov.in/memberinterface/ to access the UAN Member Portal.

- Now, under the login section, enter your UAN Number and select Forgot Password to reset your password.

- To log in to the UAN Portal, enter your UAN Number, Password, and Captcha Code after updating your password.

Features

- The UAN helps in the centralization of employee data across the country.

- This is the most important features of this unique number as it relieves the EPF organisation and the burden of employee verification from business and its employers.

- With the use of this account, the EPFO will able to extract your bank account details and your KYC data without the help and support of the employers.

- EPFO can keep track of the employee’s multiple employment changes.

Benefits of UAN:

Consolidation of EPF Accounts: With UAN, employees can link multiple EPF accounts and manage them under a single UAN. This makes it easier to keep track of their EPF balance and eliminates the need to manage multiple EPF accounts.

Online Access: UAN allows employees to access their EPF account details online. This includes checking their EPF balance, viewing their passbook, and tracking the status of their EPF claim. This makes it more convenient for employees to manage their EPF account.

Portability: UAN makes the process of transferring EPF funds from one account to another much simpler. The employee can easily initiate the transfer process online and track the status of the transfer request.

Transparency: UAN ensures transparency in the EPF scheme as employees can easily access their EPF account details and track the status of their EPF claim. This eliminates the need to visit the EPF office to get information about their EPF account.

Documents

To open a UAN account, you’ll need the following documents to receive your Unique Account Number, if you’ve recently started working for your first registered firm.

- Account information: Account number, IFSC code, and branch name are all required fields.

- ID proof: Any photo-affixed national identification card, such as a driver’s licence, passport, voter ID, Aadhaar, or SSLC Book.

- Address proof: A recent utility bill in your name, a rental/lease agreement, a ration card, or any of the ID proofs listed above with your current address on it.

- PAN card: Make sure your PAN is linked to your UAN.

- Aadhaar card: Aadhaar is required because it is linked to a bank account and your phone number.

- ESIC (Employees’ State Insurance Scheme) card number.

Generate your number

- Go to the UAN member portal first in google or any browsers

- Near the bottom right of the page, click on the online Aadhar certified UAN allotment link.

- Provide your Aadhar number and wait for an OTP to be produced and sent to your registered mobile number

- Enter the OTP and wait for the system to pull your data from the Aadhar database and fill in the required space for you.

- To get your UAN, click here. The UAN is sent to you by SMS in your registered phone number.

How can you activate your UAN

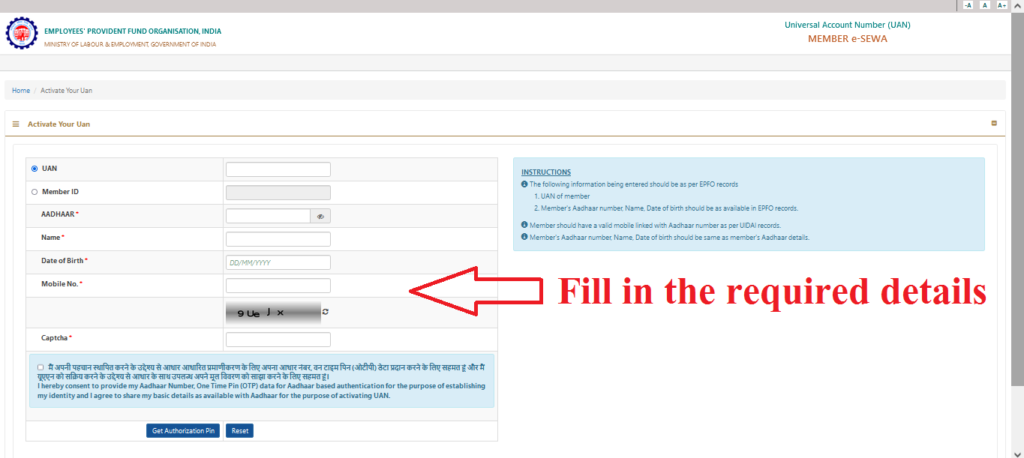

Step 1: Go to the EPF Member Portal official website.

Step 2: On the homepage, look for ‘Activate UAN’ in the ‘Important Links’ section.

Step 3: Fill in the required details such as your UAN, Member ID, Aadhaar, PAN, Name, Date of Birth, Mobile Number, and Email ID

Step 4: A PIN would be sent to your registered mobile number.

Step 5: Click on Get Authorization Pin.

Step 6: Entering the PIN.

Note : This will make your UAN active. Then, on your registered mobile number, you will receive a pin. You can sign into your UAN account using this pin. You can change your password once you’ve logged into your account. By going on to the EPFO website once your account has already been activated, you may simply follow your EPF and control your withdrawals and transfers.

Customer care service

If you need help for your EPF account, you can contact UAN customer service using the following contact information:

- From 9:15 a.m. to 5:45 p.m., call 1800 11 8005.

- www.epfindia.gov.in is the official website.

- [email protected] is the email address for employee feedback.

Employees need to have a UAN. You can use it to verify that your company does not with hold or access any of your funds. In addition, your UAN remains the same if you change jobs. You will, however, be given a separate member ID. Your Universal Account Number is linked to this ID. This will make the entire EPF transfer and withdrawal process much easier.