GSTIN: Format, Advantages, Portal or Search Tool

Nowadays, all the dealers use GST identification number, but before they used to use state VAT law with a TIN number by the state authorities in which the dealer belongs to. And service tax was charged to the service provider. But after the implementation of GST, now only one tax is charged i.e. GST tax.

For paying GST the company or the dealer needs a GSTIN (GST Identification Number) and this is the article with all the details of the GST Identification Number.

What is the GST Identification Number (GSTIN)?

GST Identification Number in short GSTIN, is a15 digit number which is a unique number and different to all. This GST identification number has replaced the TIN number which used to charge earlier by the government’s is tax registered number which needs to be registered under a new tax structure. The implement of this new GST was on 1 July 2017, in order to simplify the tax structure of our India.

It was launched by Prime Minister Narendra Modi and the main aim of GST is simply one market one tax and one charges. No separate charges can be charged by state or central government of India. It also reduced the burden of tax from the dealers and vendors.

Importance of GSTIN

According to GST, it is extremely important for any company or dealer small to big to know the GST number of India as the company’s suppliers must correctly indicate the GSTIN as when the GST invoice serial number on all invoices delivered, which leads to a correct allocation of the inputs of the tax credit.

GST Identification Number Format

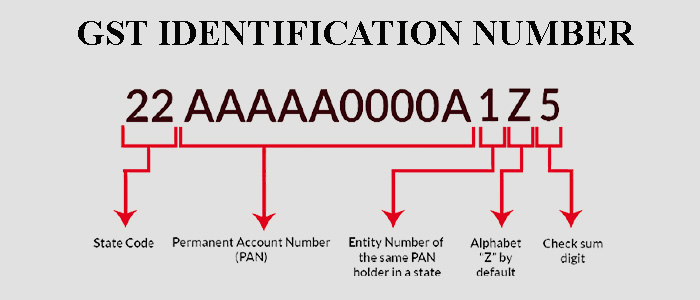

The format of GSTIN is –

- The first 2 digits of the GSTIN is the respective state code

- Assam- 18

- West Bengal – 19

- The next all the 10-digit number is the respective business PAN or Permanent Account Number.

- The 13th number is the number of respective business registration number done under the state Government.

- The 14th number is “Z” by default.

- The last digit depends it might be a number or any alphabet.

GST Number Search Tool

For getting the GST number search tool you need to follow the below steps-

- You need to enter a valid GSTIN number in the GST number search box below.

- Then Click on the Search button. If the GSTIN is correct, the company name information can be checked and verified here.

Advantages of online GSTIN search & verification tool

The advantages of Online GSTIN search and verification tool are-

- Can check the authenticity of any GSTIN without much time.

- The GSTIN of a hand-written invoice can be verified easily, if it’s unclear

- You can avoid yourself from fake GSTIN used by the fake vendors.

- You can easily avoid frauds

- Can correct the vendors if any errors occurs

The GST portal

This is portal by government of India where the citizen can give their complains. This portal helps the tax payers to solve the issues faced by them. This site is designed in such a way that the citizen can easily send screenshots of the issues they are facing.

GSTIN Authenticity

There may be times when the provider attempts to manipulate customers by abusing or misusing the GSTIN. The authenticity and validity of the GSTIN mentioned by the supplier must be verified by you before paying for tax. India GST Checker Tool and GST Calculator is a one solution for all your needs and to stop the frauds.

Verify GST Number Online Instantly

The GST search tool, is a tool with 100% online that helps with GST number verification and is just a click away on from your smartphone. The simple ways to check the GSTIN online are:

- The GSTIN verification tool : This tool pulls the data directly from the Government of India GSTN and displays the GSTIN search results. It’s as simple as searching something in google.

- Masters India – GST Search Tool : As we already mentioned, you need to enter the correct GSTIN or GST number to be queried in the search tab and hit Search and check the GST number to find the required information or find the status of the required GSTIN.

How to complain about fake GSTIN

You can easily report or file a complain on GST frauds in various ways. You can give your complain on gstportal.gov then visit CBEC MITRA Helpdesk and also choose “Raise Web Ticket” to file the respective complaint. You can also email your complain in “[email protected]”. You can choose any one to complain your issue on GST frauds and get connected to solve the issues.

Frequently Asked Questions (FAQ)

Yes, you can find the respective company address through GSTIN. Just you need to enter the GSTIN of the registered taxpayer which is assigned by Goods and Service Tax (GST) in the Masters India search tool.

For unregistered person it needs 30 days for registration

The GSTIN is one of the essential requirements for starting a business. According to the GST Act, the GSTIN must be displayed at all registered offices of a company. It helps to avoid any frauds with customers and many more.