GSTR 4: Know everything about it

GSTR 4 is a quarterly return for system combined dealers that is required to be filed. If you want to know more about GSTR4, then this article will guide you with full details about GSTR4.

What is GSTR-4?

GSTR-4 is a document that is registered by a taxpayer who has enrolled in the composition scheme must file once every three months (they are known as composition vendors). The GSTR-4 helps in recording the whole amount of sales and along with supplies made, the tax paid at the compounding rates, and the invoice-level information of purchases made by the vendors from other registered taxpayers during the entire tax period. When you buy from a registered vendor, the data from their sales returns (GSTR-1) will be available on the GSTN site as GSTR-4A) for you to use in your GSTR-4. You can also double-check the respective information before filing your return, and also can make any necessary changes if required, and can add any details that were not shown.

Who needs to fill out Form GSTR-4?

All taxpayers need to file Form GSTR-4. This includes:

- Taxpayers who decided to opt-in for the composition scheme during GST migration or initial registration and have never opted out;

- Taxpayers who decided to opt-in for the composition scheme before the start of any financial year since the GST regime was introduced;

- Taxpayers who decided to opt-in for composition but later opted out at any time during the year.

When do you file GSTR-4?

This return can be filed as soon as the quarter in interest has ended. The GSTR-4 must be filed by the 18th of the month after the quarter’s end. For example, if you need to file the GSTR-4 for the July-September quarter, you must do so by December 24th, 2017.

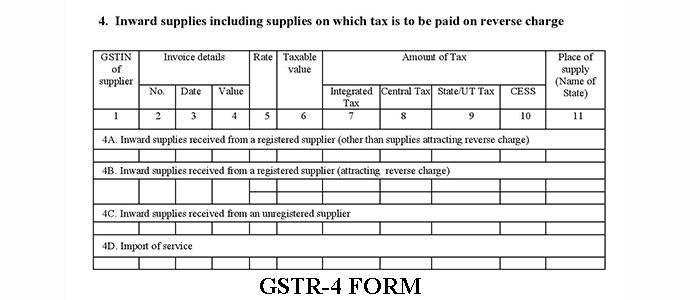

Information about GSTR-4

It is necessary to provide the following information:

- Inward supplies from an offering customer

- Inward supplies from an unlicensed supplier

- Details of Services Received -Tax rate wise inward and outward supply

- Tax rate wise inward and outward supplies -Details of TDS/TCS credit obtained

When will GSTR-4 be released?

GSTR 4 is required to be filed once a year. The deadline for reporting GSTR 4 is the 30th of April following the fiscal year in concern. The GSTR-4 for FY 2020-21, for example, is due on April 30, 2021,*. Until FY 2018-19, the deadline was the 18th of the following month the quarter’s end.

*Note: The deadline for filing GSTR-4 as an annual report for FY 2020-21 has been extended to October 31, 2020, from August 31, 2020.

Some of the main key points to remember for filing GSTR 4-

- Form GSTR 4 can only be prepared if all it shows quarterly statements in Form CMP 08 for respective financial year have been filed.

- Once filed, Form GSTR-4 Annual Return cannot be changed.

- After successfully filing, an ARN will be generated and alerted through email and SMS. At this time, the portal only allows for online filing. Soon, an offline facility for filing Form GSTR-4 Annual Return will be accessible.

Who is exempt from filing Form GSTR-4 (Annual Return)?

The following people are exempt from filing Form GSTR-4 (Annual Return):

- Non-Resident of the country(Taxpayer)

- OIDAR- Input service distributor

- Regular Taxable Person

- Person needs by the law to Deduct Tax at Source u/s 51 for any period during the financial year

- Regular citizen who is a taxpayer and has not opted in composition scheme for any period during the financial year

- Input service distributor

- Under Section 52, a person is required to collect tax at the source.

- UIN (Unique Identification Number) holder

Procedures to download GSTR -4 form

By following these steps you can download and open Form GSTR-4 (Annual Return) Offline Utility in your system from the GST Portal:

- Go to www.gst.gov.in to access the GST Portal.

- Select the GSTR-4 (Annual) offline tool option under Downloads > Offline Tools

- Extract the GSTR 4 Annual Offline Utility.xls excel sheet from the downloaded Zip file.

- Double-click the GSTR 4 Offline Utility.xls excel file to open it.

- Read the ‘Read Me’ instructions on the excel page before filling out the worksheet.

FAQ

Yes, it is necessary to file a GSTR 4 because filing GSTR-4 (Annual) is required if you were a composition taxpayer at any stage during the financial year, or. Your GST registration was canceled at any time throughout the financial year, or. During that financial year, you voluntarily opted out of the composition scheme.

An annual return, The form GSTR-4 (Annual Return), must be filed. Form GSTR-4 which is an Annual Return is on the 30th of the month following the close of the fiscal year, or as extended by the government from time to time.