What is cancelled cheque? its benefit and How to use it?

A cancelled cheque is a physical cheque that has been cancelled or marked as void by the issuer. It is a cheque that cannot be cashed, as it has already been used for a transaction or is not intended for any transaction. A cancelled cheque does not have any monetary value, and it cannot be used to withdraw or transfer any funds.

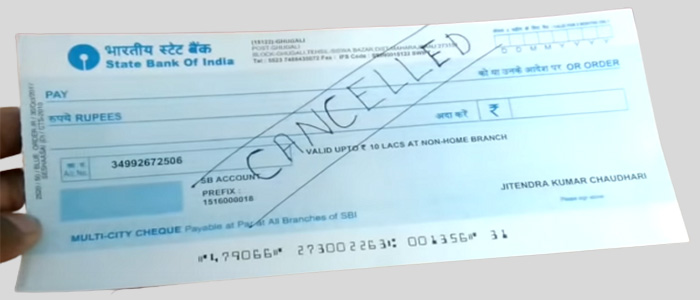

A cancelled cheque is a regular cheque with the word “CANCELLED” written between the two lines. You can also cancel a cheque if you make a mistake, such as misspelling it or entering incorrect information, or if you wish to use it as a KYC, for example. Simply writing the word “CANCELLED” on a cheque is enough to cancel it. It is generally cancelled to assure that the cheque is not misused in any way.

A cancelled cheque can also be used to show that you have a bank account. A cancelled cheque can provide account information such as account number, your name (as it appears on the bank account), MICR code, bank name, and bank branch, even though a crossed cheque cannot be cash.

Importance of a Cancelled Cheque

A cancelled cheque serves as proof of ownership of a bank account. It contains important information such as the account holder’s name, account number, and bank details. Cancelled cheques are commonly used for various purposes, such as:

- Setting up automatic payments or direct debits for bills and utilities

- Applying for a loan or a credit card

- Verifying bank details for employers, government agencies, or other organizations

How to Fill Out a Cancelled Cheque

Filling out a cancelled cheque is straightforward, and it only requires a few simple steps. Here’s what you need to do:

- Write the word “VOID” or “CANCELLED” across the cheque in bold, capital letters.

- Draw a line across the cheque from corner to corner to prevent anyone from adding or altering any information.

- If required, write the reason for cancelling the cheque in the memo or notes section.

How to Use a Cancelled Cheque

Now that you know what a cancelled cheque is and how to fill it out, let’s look at how to use it.

1. Setting Up Automatic Payments or Direct Debits

To set up automatic payments or direct debits, you may need to provide a cancelled cheque to the organization or company that will be debiting your account. They will use the cheque to verify your bank account details and ensure that they are debiting the correct account.

2. Applying for a Loan or a Credit Card

When applying for a loan or a credit card, the lender may ask for a cancelled cheque to verify your bank account details. This helps prevent fraud and ensures that the funds are deposited into the correct account.

3. Verifying Bank Details

Organizations such as employers, government agencies, or other entities may ask for a cancelled cheque to verify your bank details. This helps them ensure that they have the correct bank information for you, such as for direct deposit of pay or benefits.

Three parties to a cheque are

- Cheque Drawer: The drawer is the individual who signs the cheque or directs the bank to pay a defined sum of money via a cheque.

- Drawee of the cheque: The drawee of the cheque is the bank which has been ordered to pay the stated amount according to the cheque.

- Payee: The payee is the individual to whom the bank is required to pay the money.

Information contains in cancelled cheque

- Account number

- MICR code

- IFSC code

- Bank name

- Branch

- Account holder’s name

- Cheque number

As a result, it is recommended that the cheque should be carried carefully to avoid any misuse that could result in serious financial losses.

Write cancelled cheque

Now, you know what is cancelled cheque, so now you should know about how can you write it. So, these are the following steps for writing cancelled cheque –

- To cancel the cheque, choose a different one. Make sure you do not even put your signature on it.

- Across the cheque, draw two parallel lines.

- In block letters, write the word ‘cancelled’ between the lines.

- Cheque that the parallel lines on the cheque do not hide details such as the account number, account holder’s name, MICR code, bank name, and branch address.

Needs of cancelled cheque

- Mutual Funds – If you want to invest in mutual funds or the stock market, you’ll have to open a Demat account. To open the account, the corporation will ask you to provide a cancelled cheque to verify that the account of your bank that is associated with the investment to identify thew real identity The cancelled cheque is required in accordance with Know Your Customer (KYC) rules.

- For KYC – When investing in the stock market, mutual funds, or other financial schemes, the most important thing to present is a cancelled cheque for the verification purpose.

- For EMIs- When purchasing a gadget or a high-value item, Equated Monthly Instalments (EMI) is the most popular way of payment. Even with loans such as a car loan, a home loan, an education loan, or a personal loan, people actually pay monthly instalments. To begin the monthly instalment process, you must present a cancelled cheque as proof of bank account owner.

- EPF – Withdrawal of EPF ( Employee Provident Fund)- When withdrawing money from the EPF, a cancelled cheque is important to confirm the account details of the individual withdrawing.

Caution for cancelled cheque

To provide a cancelled cheque, just draw two parallel lines across the cheque and write ‘Cancelled’ in the space between the two lines. Your signature is not required on a cancelled cheque. It contains data such as the account number, account holder’s name, MICR code, bank name, and branch address.

While a cancelled cheque cannot be used to withdraw money from your account, it has been used in the past for fraud or theft. As a result, it’s advisable to take extreme caution while issuing a cancelled cheque and to verify that the individual to whom you’re handing it off is absolutely trustworthy.

Conclusion

Cancelled cheques could be used for a number of purposes, but they can also be misused. As a result, make sure you hand over a cancelled cheque to a correct individual who has been allowed to receive the cancelled cheque by a company or a bank. It is a vital document, but unfortunately, many of us are unaware of its significance and purposes. Hopefully, this article gives you with the necessary information about the cancelled cheque.

FAQ (frequently asked questions)

How many times I can use the cancelled cheque?

You can use for multiple times a cancelled cheque

Do I need to make sign on a cancelled cheque?

No, a cancelled cheque does not require a signature.

How can I cancel a cheque?

Simply writing the word “CANCELLED” on a cheque is enough to cancel it

What is the difference between a cancelled cheque and a void cheque?

A cancelled cheque has already been used for a transaction or is not intended for any transaction, whereas a void cheque has not been used for any transaction but is marked as void to prevent misuse.

Can I use a cancelled cheque to withdraw money from my account?

No, a cancelled cheque does not have any monetary value, and it cannot be used to withdraw or transfer any funds.

How many cancelled cheques should I provide to set up automatic payments or direct debits?

Typically, one cancelled cheque is sufficient. However, you should check with the organization or company to confirm their requirements.